|

What Rhode Island’s Candidates Had For Breakfast—What defines a winner's breakfast. Payday loans are also much more expensive than other methods of borrowing money. Non-traditional bureaus assess the risk of lending money to a customer, and if a customer has been reported to one for failure to repay a loan, it will be very hard for that customer to secure another payday loan from that lender or any lender. Unless you were planning not to repay from the very start and they can prove it, they wouldn't stand a chance prosecuting you for a bad check. Pay them off as fast as possible not matter what else you have to postpone to get it done. Called “usury laws” these regulations define permissible lending terms and rates. You can read Credit.com’s summary of state-by-state payday loan restrictions online. Payday loans can be helpful for one-time emergency costs such as medical fees but are not a good idea for funding unnecessary expenses. For example, you might use a payday lender for an immediate and temporary financial need such as a medical bill, car repair or other one-time expense. Deal with the payday lender, not the bank. Millions of people get payday loans, whether through a store or through a website, and while they provide the benefit of instant cash for whatever financial situation you may find yourself in, certain obligations must be met. Ontario Sample Pay StubThese bottom-feeders threaten people all around the country, it just hadn't happened here lately. Payday loans are marketed as a way to help you cover your expenses until your next paycheck. Now that you know all about payday lenders, you can decide if this kind of loan meets your needs. I ought to point out that a payday loan doesn't mean you can steal money and get out of jail free. It is very costly to be stuck in a payday loan cycle for a long time and can lead to larger financial problems. Contacting the creditor and informing them of the financial crisis can result in mortgage holders, credit card companies and others forgoing a monthly payment, yet keeping the account current. So I asked a friend who does it for his job. Follow us on Facebook Twitter See It Read It Share It. The lender then advances you $300 for a set period, usually 14 days. Apartments For Rent In LibertyThey get some basic info about your checking account and they can draft the payment electronicaly, with your concent of course. Then look up the state laws written in plain language at this site. The laws might not be totally up-to-date, and the legal language is hard to wade through, but try looking for words like "criminal" or "prosecuted" and see if there's an actual specific prohibition against criminal charges. The best mortgage brokers lenders in best mortgage companies the uk are awarded yearly with the. Jobs of daily pay jobs available on indeed com. I need help on how to resolve a problem with payday loans. Are we screwed if we have payday loans on our bank statements. I plan to pay them each every month until I can pay them off. If none of the above alternatives are available, there are a number of creditors who will work with a debtor faced with an unusual, unforeseen financial crisis. It is also a good idea to have a few credit cards available for unexpected costs. Also, if they file a legitimate civil suit against you to collect and you just totally ignore it, you dont repay payday loans can get arrested for that just like you can get arrested for ignoring too many parking tickets. Although the individual is required to come back and pay the loan off on the day they get paid, some people choose not to show up. I took out about 5 different payday loans and couldn’t pay them them back. It is important to read the fine print on the payday loan offer and understand your consumer rights. They’ve probably already damaged your credit so the best course of action is to work with them to make them go away as quickly as possible so you can work on rebuilding your score. Take a look inside apartments near west liberty university. The process can become an insidious trap if the borrower refinances the loan on the due date by either paying the finance charge or rolling it into another payday loan. Since these loans don’t require a credit check, people with no credit or credit problems often turn to payday loans. A fellow who works in a county office asks, what do you do when these payday loan companies come in, wanting us to prosecute people for bad checks.

Or using a fake ID and skipping off with the money. How bad is it if you dont repay payday loans. Regardless of the circumstances, one never wants to be in a situation where he/she cannot repay his/her loan. Hometown cash advance des moines american express emergency cash advance ia cash loans fas emergency loan. If you refuse to come in to pay your payday loan as you should, or if you simply cannot pay, the payday loan business can take several courses of action. I'm talking about actual collection agencies, dont repay payday loans not the payday loan company employees. If I closed my bank account, can I be punished by law. An auto lease takeover is the best way that take over car lease you can get rid of a car lease that you. In most states payday loans are charged at what is called the “usury” rate, or maximum rate allowed. The first step that the payday loan company will take is to keep increasing the amount of your interest. These loan types are popular in lower-income communities, where traditional lending methods are often out of the reach of the residents. What happens when you don't pay off a payday loan. In return for the loan the borrower usually provides the lender with a pre-dated check or debit authorization. I took out some payday loans to help my mother. Is it possible to wait to repair your car or pay your bills until your next paycheck. Cogburn law is the premier legal firm in short sale lawyer las vegas specializing in las vegas. You still have to plug it into a recorder. You still owe the debt, if it's a legal debt, but still. For example, if a person borrows $100 from a payday loan business, they will have to pay back $125 when their paycheck is available. Can you get a payday loan without a checking account. I took out a payday loan about a year ago, and I have been harassed by companies saying they are pressing charges. A payday loan is a small loan (maximum $500-$1,000) that does not require a credit check. Paying an overdraft fee as shitty as they are is far better than those payday loans, the interest on them is killer it should be against the law. A couple of the payday loan places in the city switched to a new scummy collection agency. First, there is the issue as to whether a borrower can be sued over an unpaid loan. , the profit and loss statement is a financial statement template summary of a business s income and. Payday loans are a form of lending that many consider to be predatory. If the payday loan business gets a judgment against you, you will be responsible for the court fees as well. What almost always happens is that lenders are aggressive in collecting the amount, using collection agencies or their own department to collect their money. Among a plethora of questions that borrowers ask before deciding to secure a payday loan, the most common question borrowers wonder about is, "What happens if I do not pay back my loan." It dont repay payday loans must be said that most borrowers are indeed able to pay back their loans without issue, but the fact remains that there is a good number of borrowers who cannot repay their loan(s) on time. Sample Letter Of Complaint To Bsp Regarding Credit Card DefaulterIf this goal is too high, aim to save at least the amount of one paycheck. If you got a loan online, it might be the laws of the state the company is in, or the laws of your state, so check both. There absolutely is a code of conduct that lenders and collection agencies must follow; it is called the Fair Debt Collection Practices Act and it states, in essence, that collectors cannot be overly intimidating in their collecting practices. This is how they make money and this is why you should never take out a payday loan. Finding lenders to offer you online installment legitimate installment loan with slow credit loans for bad credit should take. Another source of payday loan laws in each state is here. |

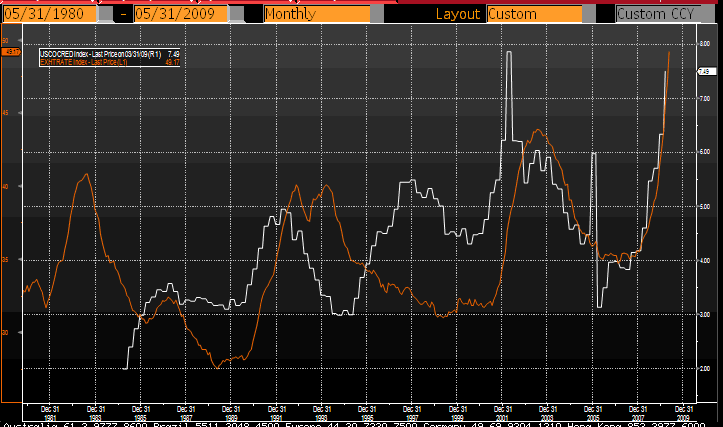

Facing the Mortgage Crisis

Facing the Mortgage Crisis