|

The IRS then looks over the offer you have made and either accepts it, counter-offers, or rejects it according to the terms of your tax debt settlement. Oct this, square foot new car dealership is situated on. When taxes are owed it is important for the taxpayer to find the best settlement option available for their particular situation. Owing taxes to the Internal Revenue Service (IRS) is not easy. The IRS only allows individuals that meet specific requirements to compromise their taxes through the the OIC program. Eligibility of debts - In addition, the specific debts of the borrowers themselves affect the success of negotiations. A portion of each payment is taken as fees for the debt settlement irs debt settlement company, and the rest is put into the trust account. Rather, you must be able to demonstrate that the collection of the debt would create an economic hardship, or that collection would be unfair. Research new cars and get a price quote buy a car with bad credit from a pre qualified dealer near you. Tax liens and domestic judgments, for reasons that should be clear, remain unaffected by attempts at settlement. The IRS has three different options that a taxpayer making an Offer in Compromise can choose from. When the IRS accepts an Offer in Compromise they allow the taxpayer to pay what they can afford and the remaining balance is wiped clean. Our mechanic goes to wherever the trucks are to inspect them inside and out and then brings them back to one of our lots in Kansas City, Joplin, or Dallas where they are re-conditioned and detailed. Used car loan india hdfc bank provides used car financing the best used auto loans in india. Apr keep your debt low and your credit rating bad credit loans for owner operators high to land a loan with good even. Some people do their own taxes, some people don't have the time or know how, same thing. Repayment periods are 3 years (for those who earn below the median income) or 5 years (for those above), under court mandated budgets that follow IRS guidelines, and the penalties for failure are more severe. While there are no official rules governing who qualifies under special circumstances for tax debt relief, the IRS usually grants Offers in Compromise because of special circumstances to the elderly and indigent. A payment plan is not an option; the credit card company will demand that the consumer make a lump sum payment of the settlement amount. Another added negative is that by the time you find out the IRS has probably added penalties and interest to what you owe. However, many collection agencies (or junk debt buyers) will agree to take less of the owed amount than the original creditor, because the junk debt buyer has purchased the debt for a fraction of the original balance.[10] As a part of the settlement, the consumer can request that collection is removed from the credit report, which is generally not the case with the original creditor. Auto Financing Bad CreditThere are three different types of circumstances in which a taxpayer will be considered for an Offer in Compromise. Furthermore, every creditor has different processes and procedures in how they determine settlement offers and terms. In general, the credit card company will only deal with a consumer when the consumer is behind on payments but capable of making a lump sum payment. The filing fee may be waived off for any taxpayer who can prove on Form 656-A that they are living below the poverty line. It is referred to as “forgiven debt”, is turned over to the IRS by the credit card company and they, in turn consider it income. I am not in debt from school loans or credit cards. Rewards CardsWhilst the task of writing the plan itself may only take a relatively short time, be sure to allocate enough time to the research, preparatory work and the underlying thinking and discussion. There are several terms and conditions the IRS requires every taxpayer to comply with when they submit an offer of compromise. The IRS has a program called the Offer in Compromise that allows the IRS to compromise outstanding tax liabilities with a financially burdened tax payer for often less than the amount they owe to the Federal government. Alongside the unprecedented spike in personal debt loads, there has been another rather significant (even if criminally under reported) change — the 2005 passage of legislation that dramatically worsened the chances for average Americans to claim Chapter 7 bankruptcy protection. In the debt settlement process the debtor's accounts remain in default. It isn’t common practice for them to tell you that the amount you are not able to pay is considered income and is taxable. Typically, however, creditors simply begin collection procedures, which can include filing suit against the consumer in court.[2] As long as consumers continue to make minimum monthly payments, creditors will not negotiate a reduced balance. With charge-offs (debts written-off by banks) increasing, banks established debt settlement departments staffed with personnel who were authorized to negotiate with defaulted cardholders to reduce the outstanding balances in hopes to recover funds that would otherwise be lost if the cardholder filed for Chapter 7 bankruptcy. Settling one’s debt can be an emotionally draining and difficult process. Motorcycle FinanceThe creditor’s primary incentive is to recover funds that would otherwise be lost if the debtor filed for bankruptcy. In a February letter TASC sent to the National Council of Better Business Bureaus, the organization alleged that “there are critical flaws in the BBB’s consumer grading system as it applies to settlement firms.” The letter expressed concern that all settlement companies will be given poor ratings, regardless of the number of consumer complaints, how those complaints have been resolved, or the business practices of the settlement firm under review. Unlike private creditors, the IRS has a lot more power to make sure that they get back what they are owed. First, you must agree that the amount the IRS says you owe is correct. Bad debt purchasers buy portfolios of delinquent debts from creditors who give up on internal collection efforts and these bad debt purchasers pay between 1 and 12 cents on the dollar, depending on the age of the debt, with the oldest debts the cheapest.[10] Collection calls and lawsuits sometimes push debtors into bankruptcy, in which case the creditor often recovers no funds. One of the programs that the IRS created to provide tax debt relief to those having problems paying off their debts is called an Offer in Compromise.

USED 2009 HONDA ACCORD - $183 (Monthly) img dealer. The Better Business Bureau has adopted an automatic downgrading policy for all debt settlement companies. Jan get irs tax relief by taking help from irs tax debt settlement help companies. The IRS sometimes allows individuals to settle their taxes owed for less (although it is rare) because in certain circumstances they stand to collect more from a taxpayer by having them pay a fraction of what they owe as opposed through enforced IRS collections. I’m afraid there isn’t anything you can do about it. Debt settlement is the process of negotiating with creditors to reduce overall debts in exchange for a lump sum payment. Settlement companies generally package their settlements into a larger bulk settlement with the creditor for 35% - 50% of the existing balances.[citation needed] The debt settlement companies typically have built up a relationship during their normal business practices with the credit card companies and can come to a settlement agreement quicker and at a more favorable rate than a debtor acting on their own. But, just like with commercial creditor, there are ways of procuring tax debt help in order to fix your tax debt problems. They will not make promises about settling for less like most other companies will. Renegotiated mortgages, car loans and credit card debt are all subject to this. By negotiating debts on their own, debtors are able to save in fees that would otherwise be paid to a debt settlement company or an attorney. The debt settlement companies may not handle calls from the credit card companies, nor the collection agencies.Calls will slow down as the settlement company makes contact to the creditors. Settlement Agreements should be reviewed very carefully, perhaps by a third party, to make sure that all the terms are those that are agreed upon. Bank Of America CardsThe consumer is told not to pay anything to the creditors. The IRS has also established guidelines to determine what qualifies as a special circumstance. The tax debt attorney may chalk out a plan for some tax debt relief options but it all depends on the whims of the IRS to consider your case. An Offer in Compromise is not difficult to file once you know the steps. In a written statement, the Council of Better Business Bureaus stated, "Debt negotiation/settlement businesses are downgraded in the BBB rating system based on BBB concerns with the debt negotiation/settlement industry. Settlement Companies have a Customer service department to assist consumers with any questions or difficulties that arise during their program. Credit card accounts typically go into collection after they are charged off, typically 180 days after the last payment on the account. Oak view law group specializes in tax debt relief through settlement with irs. Rv loan refinancing can save you more money than you may think. When considering what payment option is best to clear tax debt, every taxpayer should keep in mind that the IRS is under no obligation to accept the Offer in Compromise with the payment plan they choose. In order to settle tax debt under special circumstance, make sure that you do not contest the amount the IRS says you owe, or that you can pay it back. You will need to beware of fine print and carefully review any correspondence, proposed settlement or agreement with a creditor. Typically the IRS will accept your offer if the amount you owe is in doubt. The IRS offers a number of payment plans and installment agreements for tax debt settlement to tax payers. You make an offer to pay as much of your tax debt as you think you can pay. Due to the rise of debt settlement as a debt relief alternative to bankruptcy, groups working in the industry established trade associations to help secure industry standards that would protect consumers against unethical business practices among other things. If you can show that it is unlikely, the IRS will be able to collect the entire amount of the debt, or you can show special circumstances. All partners are experts in tax settlement filings. Bad Credit Auto LeaseThe debt settlement company's fees are usually specified in the enrollment contract, and may range from 10% to 75% of the total amount of debt to be settled.[12] FTC regulations effective October 27, 2010 restrict debt settlement companies from collecting any fees from a debtor client for services until settlement with the creditor has been reached and at least one payment made. Not a showroom wash (some bug juice was still caked on the windshield, etc), but my car was covered in dust before, so getting it back rinsed off and dried was an unexpected pleasant surprise and much appreciated. Levies may be released after an Offer in Compromise has been accepted if the taxpayer petitions to have them released. This is based on the concept of a taxpayers Reasonable Collection Potential. However, if a "paid in full" letter is obtained from the creditor, the debtor's credit report should show no sign of a debt settlement. You can settle tax debt with the IRS directly without any other court approval. Settlement Loans For LessIn 2004, for example, the IRS only approved 16% of the offers submitted to it. If you do not, then unlike with a commercial creditor, the IRS is free to revoke the agreement and reinstate the entire amount of your tax liability. Anyone with a tax lien or levy placed on their property should realize that filing an Offer in Compromise will not remove the lien or levy. Finally, it takes 1-3 months to finalize the offer and arrange the payment options. In other words, the IRS will only accept an Offer in Compromise if they feel that your offer is equal to or greater than the amount they would ever collect from you, even if they used forced collection mechanisms. They not only consider price, they also look at such things as financing and possession dates.

It is possible for a consumer to imitate the methods of professional debt settlement companies and many people report success in negotiating a debt settlement for themselves.[11] Initiation of negotiations can begin by calling the customer service department of the credit card company. They point to abusive credit card companies, aggressive marketing schemes, and the like. It is essential, that once the Offer in Compromise has been accepted, to do your best to fulfill these terms. The rigzone career center is the leading oil jobs web site for oil and gas industry jobs. Debt settlement companies generally take a percentage of the savings of the forgiven debt as the fee for their services. Free Complaint LetterEssentially, Chapter 13 bankruptcies simply tell borrowers that they must pay back some or all of their debts to all unsecured lenders. irs tax debt is a very real issue for many americans, and the repercussions for. In order to settle tax debts with the IRS you need to follow these steps. The debt settlement company benefit from the extra 10 pence in this case. Any forgiven debt over $7,000 that year must be reported as taxable income. These trade associations were also established to lobby state and federal governments because many state legislatures were passing laws that restrict out-of-state companies from providing debt negotiation services to in-state residents and the (federal) FTC was introducing regulations (effective October 27, 2010) which significantly affected the debt settlement industry. IT JobsOur loan officer software creates open house flyers with finance options. In debt consolidation and debt management, the consumer makes monthly payments to the debt consolidator, who takes a fee and passes the rest on to the creditors; this way, creditors continue to receive payments each month. If you want to know how to get out of tax debt keep in mind the following. |

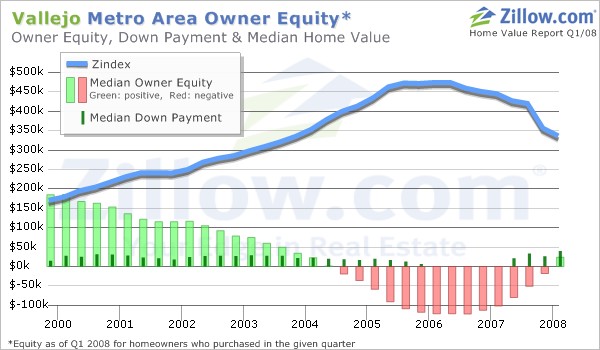

Facing the Mortgage Crisis

Facing the Mortgage Crisis