|

Ask a lawyer about any california legal issue post question and receive free. Monday through Friday, excluding holidays at (916) 874-6622 and select option "0" to speak with a tax speitt and request a contract by mail. Apr for calendar year partnerships, the installment payments for the return. Previous payments will be treated as partial payments and will not be credited to the new plan. The bulletin sets out the policy of the Ministry of Finance regarding interest. If your restaurant is experiencing a substantial increase in its customer base and adding seats isn't quite enough, why not open another location. However, after a secured tax bill becomes tax defaulted, an installment plan of redemption may be started. It must be a VA to VA refinance, and it will pay installment prior year taxes reuse the entitlement you originally used. NJ Home | Services A to Z | Departments/Agencies | FAQs. Since our house has gone under re-devlopement, we are planning to take extra space. The County of Los Angeles retains the right to initiate foreclosure proceedings when assessments related to the Los Angeles County Energy Program (LACEP) become delinquent. Ally, the only thing I miss from ING Direct is that in my checking account they would show pending, meaning those who have hit my account for a payment, but the payment is still in processing and hasn’t actually gone through all the way. They will not work with us on bi-monthly payments. Check with your tax advisor for more information. In each succeeding year, you must pay at least 20 percent of the original amount due before April 10 for secured taxes or August 31 for unsecured taxes, as well as pay all bills issued on the current roll by the installment due dates. Cardholders may be charged a fee for use of payment cards, which will vary based upon the tax amount due and the service provider selected but if you choose to pay with your Visa Debit card you will only be charged a low flat fee of $3.95 or less. There are a few choices as to how much pay installment prior year taxes is paid which I have listed below. A hospital orderly must have the skill of organization, as they handle patient information and doctor's requests. Flat fees apply only to payments made through participating service providers and other participating merchants. Chatzky program for dumping debt debt free deadline. However, a complete redemption of the property may be made with credit given for the amount paid on the installment plan. Monday through Friday, excluding holidays at (916) 874-6622 for the amount of each subsequent payment. If you are a salaried worker, you’re accustomed to having taxes withheld from your pay check every couple weeks. If you have a net tax owning of greater than $3,000 in the current year and either of the previous two years, then CRA will expect quarterly installment payments. If you choose this option, just pay the amounts shown on the reminders by each due date. Don advises a reader who wants to refinance a car loan on what to look for in. Some secured escaped assessment tax bills and unsecured business property or vessel escaped assessment tax bills may be eligible to be paid on a four year payment plan in accordance with the California Revenue and Taxation Code. Find and compare mortgage refinance rates in san antonio from hundreds of. However, if the County Assessor determines that the escape or under-assessment was due, in whole or in part, to the error, omission, or fault of the assessee, then escaped assessment penalties at the rate of three-fourths of one percent per month (.0075), are calculated from the date of the deadline for filing the written request to the date the payment is made, shall be added to the outstanding balance. Penalties will be computed on the unpaid balance each time a plan is opened and $75 application fee will be charged with each plan opening. I was not even aware of the interest being charged for not making installment payments. In your small business debt collection laws will eventually become important, as your debt small business debt collections laws. This plan provides a means of paying secured property taxes that have been delinquent for one or more years, with payments being made in five or fewer installments in accordance with California Revenue and Taxation Code. Most prior year delinquent taxes may be eligible for a five five year installment. Socialsecuritydisability com lawrence, ma social security disability massachusetts social security. When you begin composing your letters of business closure, you have to make sure that you write three types of letters for your suppliers, customers, and business partners.

The articles posted on this Canadian Personal Finance Blog are the opinion of the author and should not be considered professional financial advice. A rental is a home, so you want to make sure you pay installment prior year taxes rent one that offers the amenities you want. Basically divide last years tax owing by 4 to figure out current year installment payments. The flared bases on these toys keep them totally safe for penetration, so all you have to do is enjoy the ride. How To Initiate A Four pay installment prior year taxes Year Payment Plan. To enroll a secured escaped assessment tax on the Four Year Payment Plan, a written request must be filed before April 10th of the current fiscal year or by the last day of the month following the month in which the tax bill was mailed, whichever is later. Shortly after writing this review, I received a call from Hudson Toyota. Find out more about paying your small business taxes with your Visa card. So you’ve started a brand new business and it’s actually turning a profit sooner than you expected. When my accountant and I filed my business taxes for 2008, I owed a fairly significant amount in taxes. A trust, however, allows you to realize other objectives that a will cannot. In many cases, those seeking debt consolidation are exploring that option because they are already experiencing difficulty making their payments. I figured that since my side income had decreased I didn’t need to bother making installment payments. Your alternative is to get an FHA or VA home loan guarantee. No worries though, the government will reach into your pocket sooner or later and it’s best that you are prepared. Therefore the use of all conventional derivate instruments is impossible in Islamic banking.[36] In the pay installment prior year taxes late 20th century, a number of Islamic banks were created to cater to this particular banking market. Big store, cheap prices, WORST customer service. This will eliminate the need for installment payments in the following year. Once you have exhausted Disneyland and the other attractions, there are steam trains you can ride in the Gold Country and pan for gold in the traditional way of pioneers. Privacy Policy Conditions of Use Accessibility Notice TDD/TTY Technical Problems. 1 Instant Payday LoanWe pay your bill and you pay us back later — it's that simple. If bankruptcy has been filed and discharged and is at least 1 Day old, then this is acceptable. However, you do need a substantial upfront chunk of cash to kick-start the process — a lot of lenders ask for at least a $5,000 payment to get the ball rolling. While not binding, a letter of intent can help clarify the points of a deal or provide protection should a deal collapse. After re-calculation of the redemption penalties, the payments received through the five year payment plan are deducted from the payoff amount. |

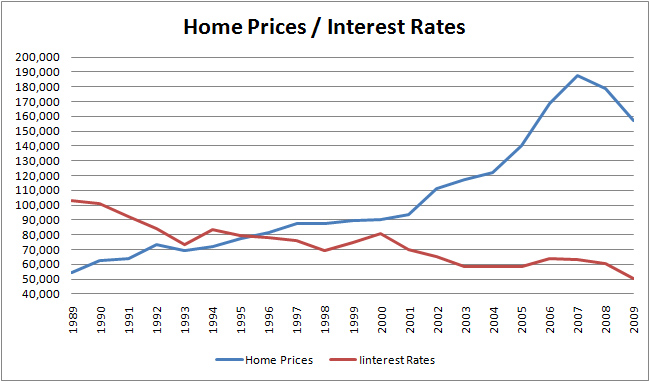

Facing the Mortgage Crisis

Facing the Mortgage Crisis