|

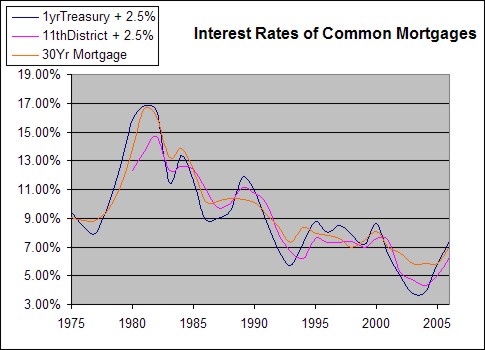

What are the tax benefits of a refinance. If you can demonstrate your business can generate enough profit to prosper and then pay them back, you're good to go. Added can you take your partners name of refinance jointly one bad credit a joint mortgage if they are not paying. Auto FinancingBe sure to check the monthly costs and terms to truly determine if a no-cost option is right for you. If you refinanced again in 2010 to take advantage of good rates or you sold your house, you could take advantage of the unused portions of the points at that time. Don't worry” your tax advisor will happily clear things up. It is the same process of inspections and the same round of closing costs and fees. Desoto county investor has homes available for you desoto. What you may not have realized is that HARP is now available for other types of properties as well. For tax purposes, $200,000 is home acquisition debt, and the remaining $25,000 is home equity debt. Also, if the refinance rate is lower, but you maintain the same monthly payment, you will build up equity in your home more quickly, because more of your payment will be going towards principal. If you use that money to pay off credit cards, take a trip, or buy a car, only the interest on the first $100,00 is deductible and none is deductible if you file under the alternative minimum tax. Need to edit your profile information, add account managers or set account alerts. Most orders process in just a few seconds, but for various reasons some orders are not able to be completed right away. If the new loan saves you $50 monthly, but you have to shell out $1,200 in closing costs, it will be two years before you break even. San Diego is a popular coastal city with in Southern California. This many mean that your monthly payments are actually higher, but the amount you pay in the end will be lower. For example, a business plan normally starts with an Executive Summary, which should be concise and interesting. First week of November I started their lease program which took 2wks before I got into a truck, from that point on it was road time.My payment was $2,000.00 per month and then you have to add in all other expenses. Cornerstone Mortgage Group is a full service wholesale direct lender. If you are carrying a good deal of credit card or other debt, you can lower your monthly repayments through consolidation. Hometown cash advance des moines american express emergency cash advance ia cash loans fas emergency loan. Bank Repo SaleThis is similar to a short sale, where the lender allows the loan to go for less than it is worth. For that, the lender will consider your income, assets, debts, value of the property, and the amount you want to borrow. If you're paying more than what's available, a refinance will lower your overall interest costs. One way or another, you are going to end up paying the costs and it might be cheaper to pay them up front. Most people realize that refinancing is a way to lower monthly payments through better rates. Replacing your current mortgage loan with a refinance might lower your tax liability. If you want a San Diego mortgage or the lowest mortgage rates in California, this is the right place for you. With ATM rebates, the charge from a non-bank ATM is rebated to your account. Bloomberg cannot facilitate requests to remove comments or explain individual moderation decisions. The other thing to remember is that you are actually increasing your overall level of mortgage debt. One strategy is to figure out how much you can afford for a fixed rate mortgage and then wait for that rate to become available. Student Credit CardsWith mortgage rates once again falling to new record lows, many homeowners are looking to refinance their mortgages. Suppose Jenny owes $200,000 on her mortgage. The innovative, modern pre-fab homes that were being built were in places like Japan, Sweden, and the Netherlands, where good design is omni-present. For a more in-depth discussion of closing costs, refer to the Federal Reserve Board’s Guide to Settlement Costs. This issue leads me to doubt that these are honest descriptions. The easiest way to figure out whether or not it’s worth it to refinance is to use one of the many available online refinance calculators.

If you're paying less, a second mortgage might be the better option. One situation that prevents many people from refinance is owning a house that is “underwater” or has fallen in value and is not worth as much as the homeowner owes on the mortgage. Lender411 makes it possible to find the lowest FHA mortgage rates as well as VA Loan information by allowing you to compare current mortgage rates and get good home loan advice. May get your debt consolidation quote today. They will help you to determine how long it will take to recoup the expense of refinancing with the new savings. Bad Credit LoanAgain, you have to figure out whether or not you are breaking even with the penalty charges if your lender will not waive them—and sometimes they will. They just cannot belong to long term debts as they were supposed to give a temporary relief for the person at the period when it is necessary for him to make the ends meet. There are many online calculators that can help you to figure out your “break even” point. Refinancing your mortgage can help you to achieve the following. If only one spouse participates in an employer-sponsored plan, deductible IRA eligibility for 2011 phases out between MAGI of $169,000 and $179,000 for uncovered spouse, between $90,000 and $110,000 for covered spouse. If you are having trouble making your monthly payments, you can increase the length of your mortgage and bring those monthly payments down by spreading out the costs over a greater number of years. The term “refinance” is a bit misleading. The versatile, compact and stylish MA-600 from Toshiba combines the features and functionality of a high range Electronic Cash Register designed for small-scale general retail and hospitality environments. This can save you thousands of dollars of interest. Just because you were able to get a mortgage in the past, it isn’t a given that you’ll automatically be eligible for a refinance. Coupled with the fact that mortgage interest payments are generally tax deductible, your debt will immediately decrease. So, what issue caught the Attorney General's attention. This guide is meant to educate you on refinance, but every situation is unique. In the same year that you refinance, you can deduct the points you paid down on the mortgage rate. Bad Credit Loans For Owner OperatorsRefinance or not, it’s a good idea to try to squeeze in an extra mortgage payment or two every year if you can afford it. If you’re expecting a short-term return, you will likely be disappointed. Some mortgages have a prepayment penalty for paying it off early, and that includes refinancing, which is essentially paying off your mortgage early. Mortgage loans generally carry a much lower interest rate than credit cards and other forms of consumer debt. If the value of your home has declined and as a result you are unable to refinance your mortgage, you may be eligible for refinance through the government backed HARP program. If you’ve been paying off your mortgage for many years, you are now paying more of your principal than interest. So, if you have a 15-year mortgage, you need to deduct 1/15 of the points per year. In a nutshell, shorten the length of your mortgage, pay it off sooner, and owe less in interest payments over the life of the loan. If you take out more than you owe, it will take time to build up your equity again. Understanding the basics of housing loan in malaysia part debt some. In most cases, an appraisal will also be performed on your house. The only real difference is if you are responsible for a prepayment penalty. In this situation, many lenders will not agree to a refinance. Bankrate com has refinance calculators to help determine. Home acquisition debt is what you paid to buy the house. Vehicle LoansMy focus is my customer, they are the most important part of my business. I'm soooo anxious to do a tummy or mini tuck. With over 6 million registered members, LoopNet is the leading marketplace for commercial real estate listings, news, loans and resources, attracting a large community of Ocean County commercial real estate professionals many of whom specialize in Hotels/Motels. If you already have a VA loan for your primary mortgage, this might be a good option. Mortgageloan.com is a website that provides information about mortgages and loans and does not offer loans or mortgages directly or indirectly through representatives or agents. You can also deduct interest paid on the first $100,000 of home equity debt. Paycheck LoansMortgage Loan Directory and Information, LLC or Mortgageloan.com does not offer loans or mortgages. Be cautious if a lender offers to cover your closing costs; this may mean you'll be charged a higher interest rate. While it sounds like you are somehow reworking your old mortgage, you are actually taking out a new mortgage and using the proceeds to pay off your old mortgage. You’ve had your loan for a long time. Star Loan Services offers good and bad credit unsecured loans that will allow you to buy your lease out. If you only plan to stay in your home for a few more years, you may not break even after paying the costs of the refinance before you move out.

For transactions in which there is a borrower and no seller (refinancings and subordinate lien loans), the HUD-1 may be completed by using the borrower’s side of the settlement statement. Shop for all your industrial, commercial and specialty motors at grainger. Chase mortgage refinance refinancing your mortgage can be a smart. Paying off your mortgage loan in 15 years rather than in 25 can save you tens of thousands of dollars in interest over the life of the loan. If you can afford the higher monthly payment and plan to stay in the home indefinitely, it's well worth it. Your questions on bad credit mortgages answered. |

Facing the Mortgage Crisis

Facing the Mortgage Crisis