|

Check the Refinance Car Loan Payment car refinancing Calculator from Up2Drive. Auto refinance offers exceptional rate savings, while lowering your car payment. Click here for online access to your account to set up automatic payments, manage your account and more. What that will do is effectively shorten your loan because your total financed cost would have been reduced when you refinanced at a lower interest rate. Refinancing can be a great way to save some money on your auto loan if you do it right. Site Map | Responsible Lending | Wells Fargo & Company. We provide these links to external websites for your convenience. An auto refinance may lower your interest rate, which means a lower car payment – and more money in your pocket each month. Oct vintage guitars, rare guitars, new guitars and used guitars for sale at. How much can investing just $25 a month really make you. Suppose you already got a good 7% APR car loan. Easily track and review certificates to eliminate errors and find problems BEFORE they affect you. A HELOC could give you a lower monthly payment than refinancing because it's a longer-term loan (usually 10-15 years), while vehicle refinancing is usually structured in two-year to four-year periods. We will pay this fee on your behalf and add it to your final loan amount. This content requires the latest version of the Adobe Flash Player. At Nationwide Bank®, we want to help you pay less on what you borrow. REGENT CONSULTING LIMITED, LONDON, mrjasonwallac1960@yahoo.com. Can i refinance my mortgage if poor credit refinance i have a low credit score. Of course, there are also borrowers who will seek to lower their monthly payments when refinancing. Please call Wells Fargo Education Financial Services at 1-800-658-3567 if any portion of the proceeds is to be used for educational purposes, or to refinance/consolidate any loan you incurred for such purposes. You must be 18 years or older to apply for an auto refinance loan. Some lenders can make you pay a portion of the remaining interest when you refinance, not just what's left on your principal. Just fill out our simple and convenient auto refinance calculator and quickly determine if refinancing will save you money in the long run. The insurance products and services offered through these affiliates of Nationwide Bank are not insured by the FDIC or any federal government agency, nor are they guaranteed by, deposits of or obligations of Nationwide Bank. If you're approved for refinancing, the process itself is fairly simple. If all your documents are complete and accurate, it should only take 7–10 business days to complete your loan and issue the funds to your previous lienholder. Here's another example with the same $16,500 car refinancing loan for 60 months mentioned above. Wells Fargo does not endorse and is not responsible for their content, links, privacy policies, or security policies. Geico Car InsuranceBankrate can help you determine how the interest on your loan is computed. Refinance your car and save money, or just lower your monthly payment by extending the length of your loan. Check out our directory of private money lenders in new york, who loan private. The first step is to review your current loan documents. Use the money you save to pay off credit card debt or accelerate your car loan payoff. We want you to feel comfortable in your borrowing decision, whether it means refinancing your existing loan, securing a new car loan or holding off until the timing is right. I bought furniture at the ashley city furniture store in ft. You can use the power of your auto with a car refinance loan to roll your bills into one, easy-to-manage payment and pay off higher interest rate balances. Before you refinance, it's important to understand that a positive tool car refinancing like refinancing can be used in shortsighted and reckless ways. Sep to create a new apple id for use on itunes no credit store, app store, ibookstore, and.

Moreover, we do not select every advertiser or advertisement that appears on the web site-many of the advertisements are served by third party advertising companies. From there, you start paying your new lender monthly. Jan get answers to how does refinancing a car loan work. Home Page > Finance > Credit > Credit Card Debt Settlement Proposal Letter – Must Read Tips. We’re here to help you make the financing choice that’s right for you. Otherwise you're going to pay about half a percent more for used-car financing. Low interest unsecured personal loans are generally available to borrowers with excellent credit scores, but secured personal loans will provide the lowest interest rates possible. Likewise, if interest rates were high when you purchased your car but have since come down, refinancing is a prudent option, according to LendingTree.com. The potential advantages of refinancing are twofold. Other rates, terms, payments and loan amounts are available. The calculator will show your monthly savings and the number of months that it will take to earn back your loan costs. If you did, the benefit of refinancing to save on total financed cost is lost. The form you need to fill out varies based on your state. View the documentation requirements to understand which form you will need to complete. A safe deposit box may have to car refinancing be forfeited in a bankruptcy. After we receive and process your completed documents, we'll send you car refinancing a Welcome Letter indicating that the refinance process is complete. Capital One Auto Finance is also one of the biggest online lenders, with attractive rates for qualified borrowers. It's like finding a wad of cash you didn't know you had in your clothes after doing the laundry. Cheap LoansFor auto refinance loans, we will send the check directly to the lender. Refinance your auto loan with Nationwide Bank® and save. Now that your car payments have dropped dramatically, don't squander your savings. If you’ve ever thought about refinancing your existing auto loan, now is the time to find out if it’s the right choice for your situation. It is not, however, for people looking to save money in the long run, because it increases the overall cost of the loan. APR is effective as of 11/1/2012 and subject to change. Motorcycle FinanceCar refinance is the same as home refinance. Nationwide Bank does not offer a guarantee car refinancing of the calculator results. It boasts even more interior room this model year, offered in LX, EX and EX-L trims. I highly recommend you either use that savings to payoff your high 18% APR credit cards, or send in extra principle on your already lowered auto refinancing loan and pay it off even sooner, and save even more money on interest. There may also be prepayment penalties in your original loan agreement that can make refinancing a costly option. Home insurance also protects you if you're legally liable for someone's injuries on your property, as well as from financial losses caused by storms, fire, theft and other events outlined in your policy. The products and services offered through Nationwide Investment Services Corporation are subject to investment risk, including possible loss of value. Depending on when you refinance with us and when your next auto loan payment is due, you may be able to skip next month's auto loan payment. Don’t forget that Nationwide can provide you with the insurance you need to stay protected on the road. While many lenders and banks provide a range of financing plans for manufactured homes, including fixed- and variable-rate loans, another hefty portion stays away from the market altogether. But it's important to understand that refinancing your car through a home equity loan secures your auto loan with your home, so if you stop making payments on your auto loan, you may risk losing your home. When would my next car refinance payment be due. Chase airline credit cards offer points to earn you airline miles. Use the friendly online lenders that we review here, like Capital One Auto Finance, Up2Drive and myAutoloan.com.

You’ll also pay less over the life of your loan. What APR % should you look to refinance a car at. Complete, sign and date the required forms in your refinance loan package. That's why some approved customers close their car refinance loans the same day they apply. Jul refinancing your car loan article on edmunds com. Apartments For Rent In LibertyFor instance, using the example above, if you continued to pay $622 a month after refinancing the loan, you would have your car paid off after about 45 months, rather than 48 months. To find a better rate, though, you'll need to shop around. Because the first monthly payment on your new car loan will be due 30 to 45 days after the closing date, and the closing date will be 0 to 30 days after the most recent monthly due date of your existing car loan, you will not have a scheduled monthly payment due for 30 to 75 days. Rate quoted is the lowest rate for qualified applicants. |

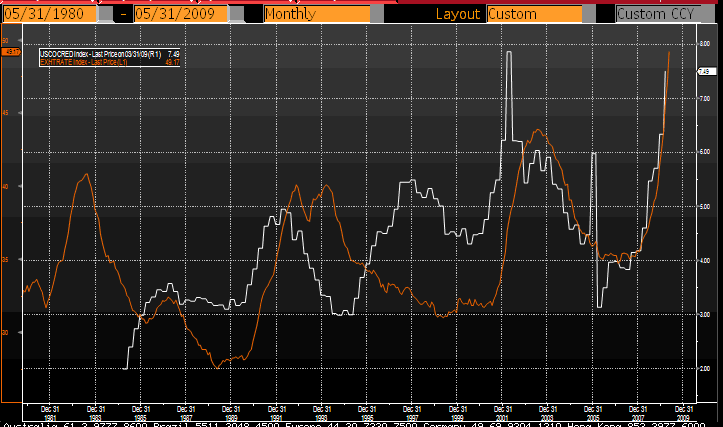

Facing the Mortgage Crisis

Facing the Mortgage Crisis